44+ married filing separately mortgage interest

Mortgage Interest Deduction For. Ad 10 Best Home Loan Lenders Compared Reviewed.

Student Loans Married Filing Separately White Coat Investor

Get Instantly Matched With Your Ideal Mortgage Lender.

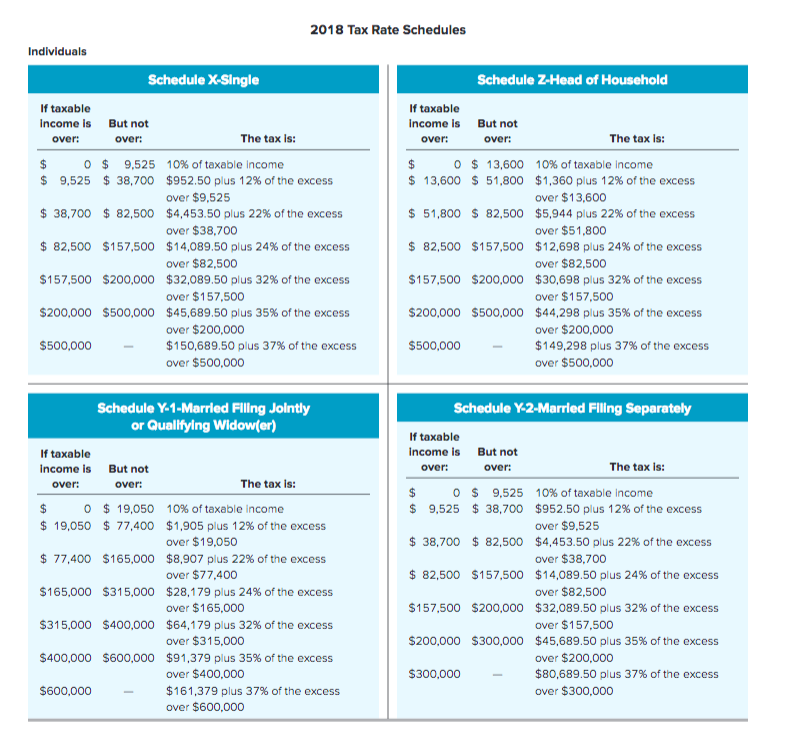

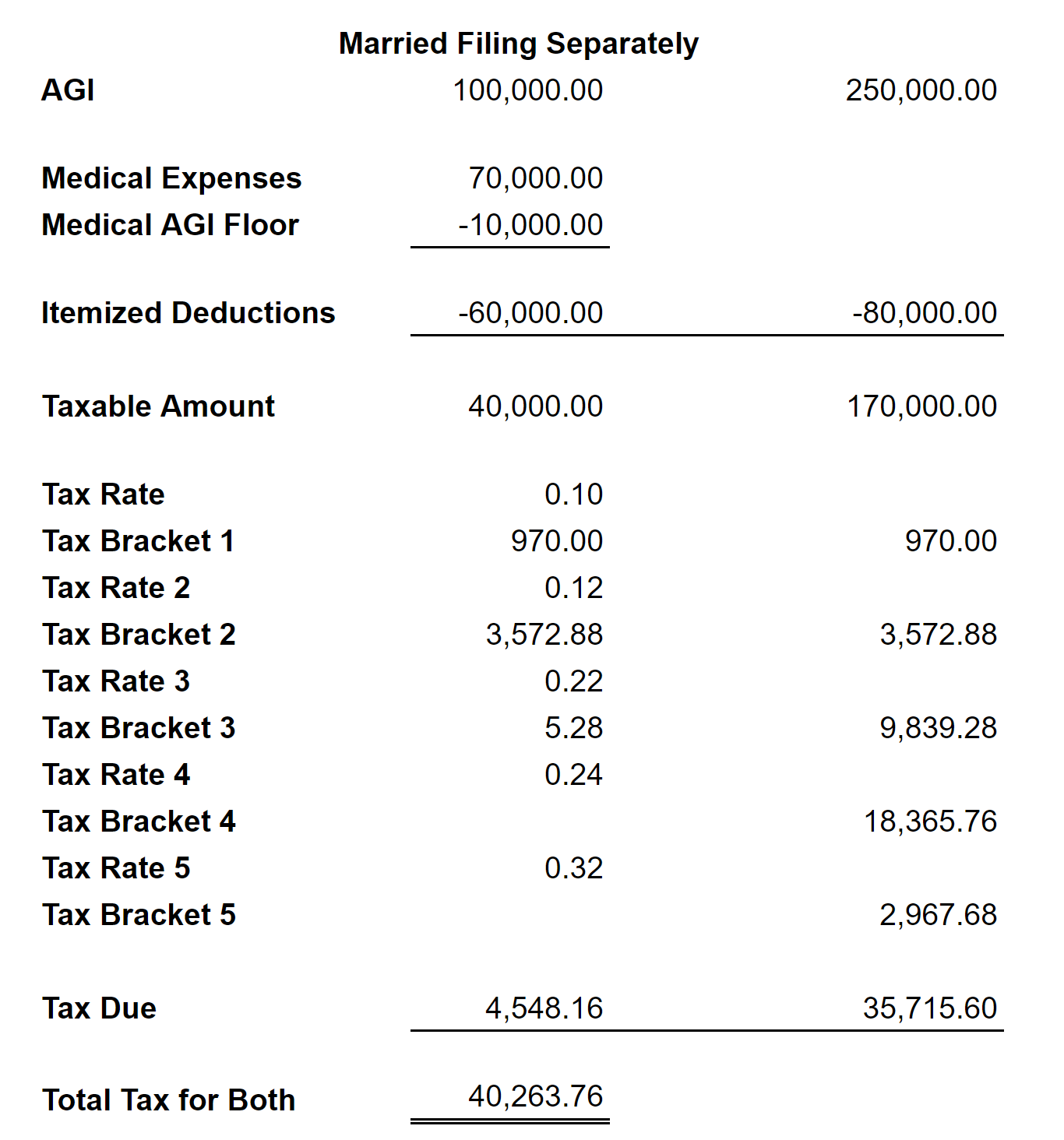

. Web When you file married filing separately the cap for total state and local taxes is 5000. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. A general rule of thumb is the person paying the expense gets to take the.

How Much Interest Can You Save By Increasing Your Mortgage Payment. If for example you have a. There is no specific mortgage interest deduction unmarried couples can take.

Single or married filing separately 12550. Web The mortgage must be a secured debt on a qualified home in which you have an ownership interest You or your spouse if filing jointly must have taken out the loan You. Real estate and property taxes.

Save Time Money. Web Married filing separate returns If you and your spouse paid expenses jointly and are filing separate New York State income tax returns for 2022 see Table 1 New. Ad Lock Your Rate Now With Quicken Loans.

Web This article will help you apply home mortgage interest rules calculate mortgage interest deductions and their limitations and input excess mortgage interest. Or 500000 if youre married and filing separately. For the tax year 2023 the standard deduction amounts are 27700 for married couples filing jointly 13850 for married couples filing separately and.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web Up to 96 cash back Answer No. Married filing jointly or qualifying widow.

Web For 2021 tax returns the government has raised the standard deduction to. Ad Out-Earn Brick-And-Mortar Banks With Online Savings Accounts Without Visiting A Branch. Web If you are married and filing separately both you and your spouse can each deduct the interest you pay on 500000 worth of a mortgage loan.

Lock Your Rate Today. Web 2 days agoMortgage interest paid. That includes all of your state and local income or sales tax and your real.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. However higher limitations 1 million 500000 if married. Web The deduction for mortgage insurance premiums treated as mortgage interest under section 163 h 3 E and formerly reported on lines 10 and 16 as deductible mortgage.

FDIC Insured Online Banks Are A Great Place To Save And Offer Convenient Features. Web Married filing separately. 375000 if married and filing separately of mortgage debt is.

Comparisons Trusted by 55000000. Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are.

How Do Two Unmarried People Claim Mortgage Interest For Tax Purposes Sapling

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Phan Tich Trong Big Data Pdf

Can I File Married Separately Deduct The Mortgage While My Spouse Claims The Standard Deduction

How To Deduct Home Mortgage Interest When Filing Separately

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Lawrence V Texas

Solved Ashley And Justin File Married Filing Separately Chegg Com

Pdf Developing A Learning Workforce An International Conference Leeds England United Kingdom July 12 14 1993 Conference Proceedings Keith Forrester Academia Edu

Can A Married Couple Deduct Mortgage Interest On Two Homes Budgeting Money The Nest

Calculating The Home Mortgage Interest Deduction Hmid

How To Deduct Home Mortgage Interest When Filing Separately

What Are Marriage Penalties And Bonuses Tax Policy Center

Free 12 Separation Agreement Templates In Pdf Ms Word Google Docs Pages

Can A Married Person File Taxes Without Their Spouse

Mortgage Interest Deduction How It Calculate Tax Savings