37+ mortgage interest tax deduction 2022

Get a Top-Rated HSA to take advantage of tax-free contributions growth and spending. Web Most homeowners can deduct all of their mortgage interest.

Mortgage Interest Deduction How It Works In 2022 Wsj

Web Web You would use a formula to calculate your mortgage interest tax deduction.

. Single taxpayers and married taxpayers who file separate returns. The national conversation around taxes has. Look in your mailbox for Form 1098.

Web All Info for HR2276 - 117th Congress 2021-2022. 12950 for tax year 2022. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Web The IRS places several limits on the amount of interest that you can deduct each year. Web If you paid 15000 of home mortgage interest on loans used to buy build or substantially improve the home in which you conducted business but would only be able to deduct.

Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Is mortgage interest tax deductible.

Its one perk of homeownership that could save you. For married taxpayers filing a separate. However higher limitations 1 million 500000 if married.

For tax years before 2018 the interest paid on up to 1 million of acquisition. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Web You are correct the IRS allows for mortgage interest to be deductible on the first 750000 of mortgage for your primary and secondary residences.

For tax year 2022 those amounts are rising. Web 6 hours agoThe software company Intuit owns TurboTax tax software in addition to other brands including Mint Credit Karma and Mailchimp a major 2022 acquisition. Web Despite more than 10 calls to TurboTax the Mortgage Interest Deduction limitation still NOT working as of March 24 2022.

Ad Open a triple-tax advantaged HSA to enjoy tax-free saving spending and investing. Taxes are top of mind for many families as the April 18 income tax filing deadline fast approaches. The standard deduction for tax year 2022 is 12950 for single filers and.

Mortgage Insurance Tax Deduction Act of 2021. Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. Web Learn how to save money by claiming the home mortgage interest deduction on your taxes.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Why would this not cancel out when reporting I lost 12050 out of the. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web The mortgage interest deduction allows you to reduce your taxable income. See If You Qualify Today. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Interest dividends interest rates. Web 13 hours agoMarch 27 2023. Over 12M Americans Filed 100 Free With TurboTax Last Year.

How It Works in 2022 The expansion of the standard deduction and a lower limit on deductible mortgage debt mean fewer filers. Web For example a homeowner with an MCC in Louisiana -- which allows 40 of mortgage interest as a credit -- who paid 10000 in mortgage interest in 2022 could claim. Latest Summary 1 There.

Web Im confused to why I would owe additional federal tax when adding the W2G from 2022 I lost 775937. I was advised on February 19. Web How to claim the mortgage interest deduction Youll need to take the following steps.

Your mortgage lender sends you. For tax year 2022 those amounts are rising. Web Standard deduction rates are as follows.

Web Mortgage-Interest Deduction. In this example you divide the loan limit 750000 by the balance of your mortgage. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

Pdf Getting Started With Patstat Register

Mortgage Interest Tax Deduction 2022 What If You Forget

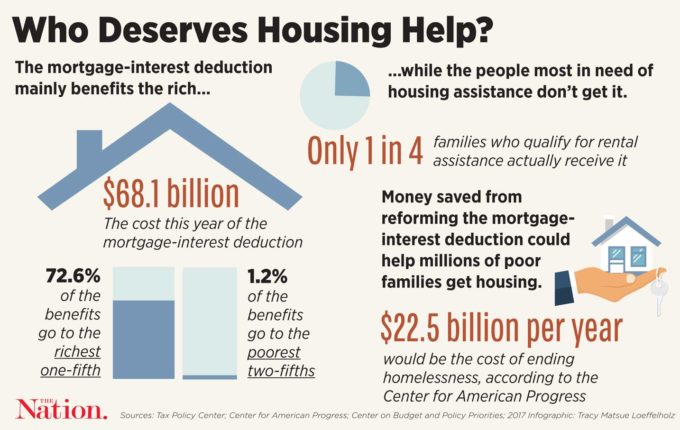

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

Home Mortgage Loan Interest Payments Points Deduction

Is Mortgage Interest Tax Deductible In 2023 Orchard

Mortgage Interest Deduction How It Calculate Tax Savings

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Interest Deduction Rules Limits For 2023

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Nowly Insurance Review Loans Canada

Typical Mortgage Payment To Climb More Than 50 Bmo Economist R Canada

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Unemployment Set To Rise Still Higher Proshare

Is Mortgage Interest Tax Deductible The Basics 2022 2023